Delaware LLC Annual Maintenance Overview

If you own a Limited Liability Company in Delaware, you’ll be responsible for an annual tax payment totaling $300, possibly more. The penalty fee for filing late is $200, plus interest.

Too many business owners forget to file their tax on time, then get slapped with a hefty bill.

This is where we step in. When you sign up for our registered agent or business formation service, you won’t have to worry about this filing. That’s because you’ll automatically be enrolled in Renewal Service, so we’ll complete your annual filing for you.

Upon signup, you’ll also receive:

- Secure Online Account

- Professional Business Address

- Basic Mail Scanning

- Domain + Website + Email + Phone #

- Filing Experts at Your Fingertips!

This company has helped us for years and really happy with the services they provide. Great customer service and support.

– M Certoma, Google Review

We Make Your Life Easier

When you hire us as your registered agent,

we take care of your annual tax filing for you!

You’ll automatically be enrolled in Renewal Service, which — for a fee of $100/year plus state fees — means we take on the responsibility of filing your annual tax so you never have to worry about missing a deadline.

And if you’d rather take care of this filing on your own,

we send you reminders with plenty of time to opt out.

LLC Annual Tax Overview

Limited Liability Companies registered in Delaware do not pay a franchise tax or file an annual report. Instead Delaware LLCs must pay an annual tax. This is also referred to as an LLC Franchise Tax, or an Alternative Entity Tax.

The annual tax is the same flat fee of $300 each year, making it a lot easier and more straightforward than the Annual Franchise Tax that Delaware Corporations are required to pay.

| Entity Type | Deadline | Annual Tax Fee |

| LLCs, LPs, GPs | June 1 | $300 |

How to File the Annual Delaware LLC Tax

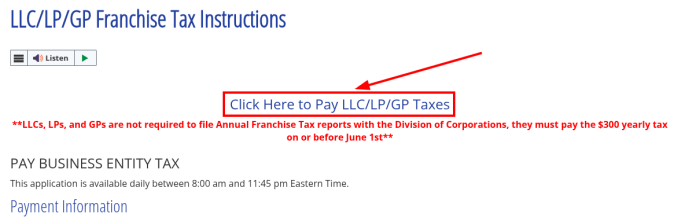

1. Visit the Delaware Division of Corporations Website

The only way to pay and file an annual Delaware tax payment is online. Simply visit the Delaware Division of Corporations’ Tax Instructions page to get started.

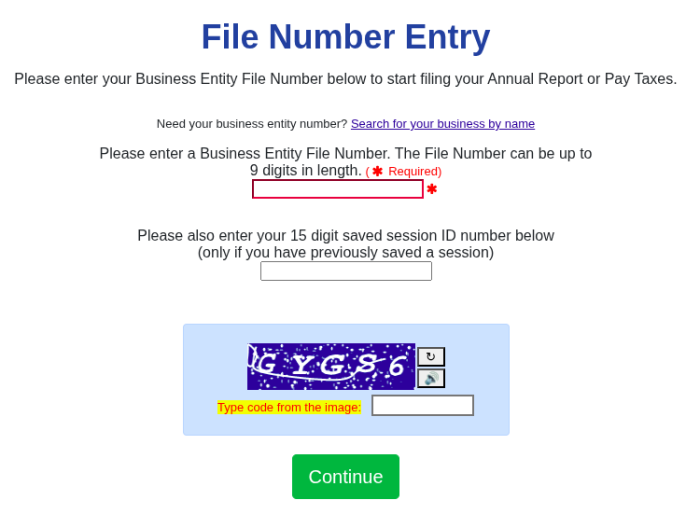

2. Enter Business Entity File Number

Your Business Entity File Number is the 9-digit number that was assigned to your LLC when you formed it with the Delaware Division of Corporations.

I forgot my number — where can I find it?

Your Business Entity File Number will be highlighted as part of your LLC’s name when you perform a business name search.

3. Pay the Annual Tax

You can make your tax payment with either an electronic check (ACH Debit) or with any major credit card. If you miss the filing deadline, you’ll have to pay an additional $200 penalty fee, plus 1.5% interest per month, based on the combined tax and penalty fee. Here’s how it breaks down:

| Months Late | Interest Added | Total Owed |

| First Month | $3 | $203 |

| Second Month | $3.05 | $206.05 |

| Third Month | $3.09 | $209.14 |

| …Twelve Months | 3.43 | 232.12 |

The Easiest Way to Avoid Penalty Fees?

Hire us! When we’re your registered agent, you’re also enrolled in our low-cost Renewal Service, which means you don’t have to worry about facing hefty fines for failing to file your annual report. We’ll take care of it for you! Still prefer to file on your own? Easily cancel in your account.

Frequently Asked Questions

When is the Delaware LLC tax due?

The due date for all LLCs is June 1st. It does not matter whether you are a domestic Delaware LLC or an LLC formed in another state and just registered to do business in Delaware — same deadline.

Do I have to list the names of members of managers when filing Delaware’s annual tax?

Delaware LLCs do not have to list the members or managers when making their annual tax payment. Listing information about your business is typically required of annual reports. But — unlike corporations — LLCs in Delaware don’t have to file an annual report.

Is there a penalty fee if I don’t file my LLC tax on time?

There is a $200 late fee if you miss the June 1st filing deadline. Interest accrues at a rate of 1.5% on the tax and late payment, which means you’ll probably have to pay $500+ if you fail to pay your annual tax on time.

Fortunately, you can avoid the headache of annual filing deadlines with us!

What is Renewal Service?

Renewal Service takes the hassle of annual filings away from you by giving the responsibility of filing your annual LLC tax to us. Each year, we’ll take care of your annual tax for you, ensuring your company remains compliant with the state. We charge a $100 service fee

Want to file your annual tax yourself? No problem. You’ll receive notifications about the upcoming deadline we in advance, so you can cancel this service and take care of everything yourself.

Avoid Late Fees with A Registered Agent, Inc.

We take care of your annual state filing so you can take care of your business.

A Registered Agent, Inc. Ratings

Our customers have provided 62 reviews, giving us an overall rating of 4.3 stars out of 5 on Google