Delaware Annual Report &

Corporate Franchise Tax

Incorporating your business in Delaware isn’t fully complete after you register with the Delaware Division of Corporations. You also have to keep up with mandatory annual filings.

When we’re your registered agent, you’ll have no need to worry about missing your annual filing because our Renewal Service will take care of it for you.

Upon signup, you’ll also get the following suite of business support services:

- Secure Online Account

- Professional Business Address

- Basic Mail Scanning

- Domain + Website + Email + Phone #

- Filing Experts at Your Fingertips!

Annual Report Deadline Approaching?

Don’t Fret. We’re On It

Failure to file an annual report on time can result in hundreds of dollars in late fees — which happens to business owners all the time. But we won’t let that happen to you.

Whether you hire us for registered agent service or business formation, you’ll automatically be enrolled in Renewal Service, which means we’ll stay on top of your annual report deadlines so you don’t have to.

A Registered Agent is the absolute BEST Registered Agent service around. Every interaction with their staff has been such a wonderful and pleasant experience!

– J Beebe, Google Review

Annual Report and Franchise Tax Overview

Delaware corporations have a franchise tax and annual report due every year. The only way to file an annual report is to file online. Or you can pay a Delaware Registered Agent to do it for you.

| Entity Type | Deadline | Annual Report Fee* |

| Delaware Corporation | March 1 | $50 |

| Nonprofit Delaware Corporation | March 1 | $25 |

| Foreign Delaware Corporation | June 1 | $125 |

* Franchise tax fees vary depending on several factors. See the How to Calculate Domestic Delaware Corporations Franchise Tax section for more detailed information.

What’s a foreign corporation?

In Delaware, an LLC or Corporation that is formed with the Delaware Division of Corporations (DDC) is considered a domestic business entity. Any business that formed in a different state is considered a “foreign entity” in Delaware.

So, if you form a corporation in Pennsylvania and plan to do business in Delaware, your company will be considered a Foreign Corporation in Delaware.

Steps to Filing Delaware Annual Report and Franchise Tax

There are 4 main steps you’ll need to take to satisfy your annual filing obligation in Delaware:

Filing Tips

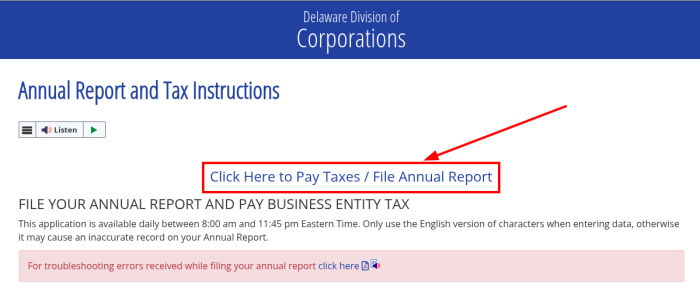

- Where to File: You can file your Delaware franchise tax report for a Delaware corporation on the state’s Annual Report and Tax Instructions page.

- How to Calculate: If you have more than 5,000 authorized shares, you can calculate your Delaware franchise tax fee using the state’s Franchise Tax Calculator.

- Foreign Corporations: Foreign corporations cannot file online, but instead must mail or fax their annual filing documents to the state.

Ready to start your business the easy way?

1. Go to the Delaware Division of Corporations Website

Corporations that were originally formed in Delaware must file online here: Delaware Division of Corporations Annual Report and Tax Instructions.

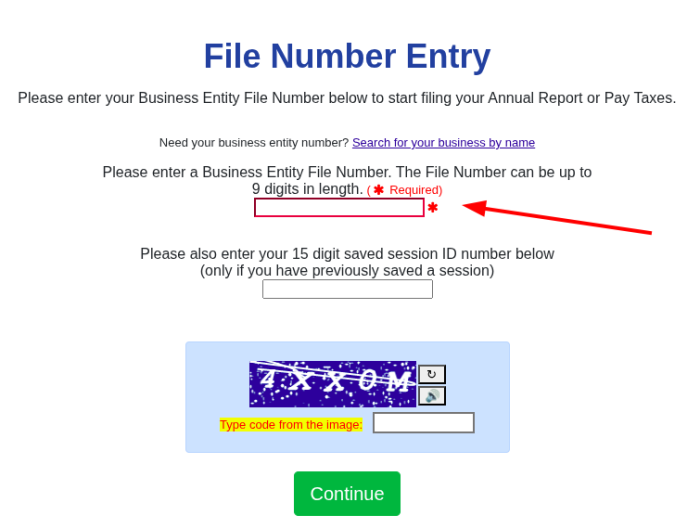

2. Enter Business Entity File Number

After clicking the “Pay taxes/File annual report” button on the Division of Corporations website, you’ll need to enter the Business Entity File Number.

What if I forgot my number?

You can find your business’s Entity File Number by performing a business name search. The number will be highlighted as part of your business’ name search result.

3. Enter Corporation Information

When you enter your Business Entity File Number, you will then be taken to a page that combines the annual report and franchise tax information. You’ll need to enter the following information:

- Federal Employer Identification Number (EIN)

- Physical address for Your Corporation

- Names and Addresses of Officers (if any)

- Names and Addresses of All Directors

- Name, Title, and Address of Person Completing the Filing

4. Pay the Franchise Tax and Annual Report Fee

You can pay with electronic check (ACH) or any major credit card. Once the payment is complete, you’re done — until next year.

There is a minimum tax of $175 and a minimum filing fee of $50; so there is a minimum Delaware franchise tax and annual report payment total of $225 a year for Delaware domestic corporations. Domestic corporations must file by March 1 or face a $200 penalty, and a 1.5% interest rate on the amount due.

The Easiest Way to Avoid Penalty Fees?

Hire us! When we’re your registered agent, you’re also enrolled in our low-cost Renewal Service, which means you don’t have to worry about facing hefty fines for failing to file your annual report. We’ll take care of it for you! Still prefer to file on your own? Easily cancel in your account.

- The lowest tax you’ll pay with the Authorized Shares Method is $175.

- The lowest tax you’ll pay with the Assumed Par Value Method is $350.

Delaware Franchise Tax Due Dates and Fees

|

Entity Type |

Due Date |

Fee |

| Corporation | March 1 | See Below |

| Benefit Corporation | March 1 | See Below |

| Foreign Corporation | June 30 | $125 (Annual Report Fee) |

| Nonprofit Corporation | March 1 | $25 (Annual Report Fee) |

| LLC | June 1 | $300 |

| Foreign LLC | June 1 | $300 (Annual Report Fee) |

| General/Limted Partnerships | June 1 | $300 |

| Limited Liability Partnerships | June 1 | $200 per partner |

How to Calculate Domestic Delaware Corporations Franchise Tax

The Delaware Corporation Franchise Tax can be calculated through two methods: the Authorized Shares Method or the Assumed Par Value Method. When you receive your tax statement, Delaware has calculated the amount you owe using the Authorized Shares Method.

You are allowed, however, to calculate the tax you owe based on either method.

So, if your tax statement says you owe more than $350, it may be worth your time to calculate your tax based on the Assumed Par Value Method. It may turn out that you can pay a lower tax.

Authorized Shares Method:

This calculation is based on the total number of shares authorized, not the number of shares issued to shareholders.

Here’s how it breaks down:

- 5,000 Shares or Less: $175

- 5,001 Share to 10,000 Shares: $250

- Every 10,000 Additional Shares Above 10,000: $75 for each 10,000

- Max Payment: $180,000

If you are a small, medium, or closely held large corporation, there is no need to be paying any more than $225 total for your Delaware Franchise Tax each year ($175 tax, $50 filing fee).

If you are overpaying you should see our page on how to save money by amending your authorized shares.

Assumed Par Value Method:

This method is based upon the issued shares, the authorized shares and your Corporation’s total gross assets. Your gross assets are reported on your federal tax return (Form 1120, Schedule L).

- First, divide the gross assets by the issued shares. The resulting number is known as your Assumed Par Value.

- Next, multiply the APV by the total number of authorized shares. This new number is known as your Assumed Par Value Capital.

- Finally, the tax you owe is $350 for every $1,000,000 of your APVC. If your APVC is above $1,000,000 you need to round up to the next million.

Corporations are required to pay the Franchise Tax and an additional $50 fee. If you do not file on time, there is a $200 late fee and a 1.5% interest assessed on the tax balance.

Frequently Asked Questions

Do I have to file an annual report and pay franchise tax for a foreign corporation in Delaware?

Corporations that are formed out of state and registered to do business in Delaware pay a $125 registration fee. However, foreign corporations (corporations formed in another state or jurisdiction) cannot file online. The foreign corporation form gets mailed to us, and we scan it into your online account. You can print it out and mail or fax it into the state of Delaware with the payment. Franchise taxes for corporations registered to do business in Delaware are due by June 30th of each year.

Foreign corporations can mail their franchise tax to:

Delaware Division of Corporations

Attention Franchise Tax

410 Federal Street, STE 4

Dover, DE 19901

If I live in a different country, is my corporation a foreign corporation?

Even if you are a foreigner located outside of the U.S., your Delaware Corporation is NOT a foreign Delaware corporation. If the corporation was formed in Delaware, it is a domestic Delaware corporation, no matter where you actually live.

Are there late fees if I miss the Delaware Annual Report and Franchise Tax filing deadline?

There is a $200 penalty if you miss the deadline for filing, and 1.5% a month interest on the amount due. The Division of Corporations pull in a TON of money off hammering people with late fees and interest. As your Delaware registered agent, we send you a ton of reminders to file this to hopefully save you some money. Don’t waste $200 on late fees. Just get it filed and move on.

What is Renewal Service?

When you sign up for Registered Agent or Business Formation Service, you’ll automatically be enrolled in Renewal Service, which means we’ll file your annual report with the Delaware Division of Corporations for you. Forgetting to file your annual report can result in hundreds of dollars in penalty charges, but we don’t think you should have to worry about that — that’s why we stay on top of your filing deadlines for you.

Our filing fee is $100, and we send get plenty of notifications before the filing deadline so you can easily cancel this service if you’d prefer to file your annual report yourself.

Relax, We Got It!

As your registered agent, we’ll take care of your annual report for you,

so you can take care of your business.

A Registered Agent, Inc. Ratings

Our customers have provided 62 reviews, giving us an overall rating of 4.3 stars out of 5 on Google