Expand Your Business Outside Delaware

From tax advantages to business-friendly laws, it’s a no-brainer why so many people choose to form companies in Delaware. But what if you conduct business in another state and need to register there, as well? We got you covered.

On this page, we’ll go over:

Get a DE Business & Much More!

When we form your company, you’ll be able to register in other states. Plus, you’ll get the following for no additional costs:

- Secure Online Account

- Professional Business Address

- Basic Mail Scanning

- Domain + Website + Email*

- Business Phone Number

- Filing Experts at Your Fingertips

*Learn more about Delaware Business Identity.

Benefits of Forming a Business in Delaware

Here are some of the main reasons why so many people across the country (and around the world!) choose Delaware as their state of formation:

- Tax Advantages. Delaware doesn’t impose a state sales tax, which is great if you live or work here. But more important for DE businesses that operate elsewhere is the fact that you won’t be charged state income tax if you don’t conduct business here. Plus, Delaware doesn’t tax “intangible income,” like patent and trademark leases. Many businesses are formed here for the sole purpose of registering a patent or trademark.

- Business-Friendly Laws. Delaware is the only state in the nation to have a Court of Chancery, which is an old-fashioned way of saying: business court. Because this court system is ruled by judges (not juries) and has a long case history related entirely to business law, court proceedings are usually decided much more efficiently than they would be through a traditional court system—and and they often rule in favor of businesses.

- Data Protection. The Delaware Division of Corporations does NOT publicize formation information (like names and addresses of your members, managers, or directors), which is a huge benefit for companies that want to keep internal names and contact information off the public record. NOTE: privacy protection is one of our core values, so you get that from us no matter what.

Reasons to Register Your DE Business in Another State

Depending on the scope of your operations, you might be obligated to register your business in another state. Here are some reasons why:

- Hiring Employees. Even if your business operates inside Delaware, hiring even one employee who works in another state would require you to register your business there.

- Owning a Warehouse. If your products are stored at a warehouse outside Delaware, you’d need to register your business in the state where you keep that warehouse.

- Manufacturing Products. Paying to manufacture goods outside Delaware is usually grounds for registering your business in that state.

- Operating a Storefront. This might seem obvious, but plenty of businesses based in states other than Delaware still choose to form their businesses in DE. If this is the case for your business, you’ll have to form your business here then register your business in the state (or states) where you have a physical presence.

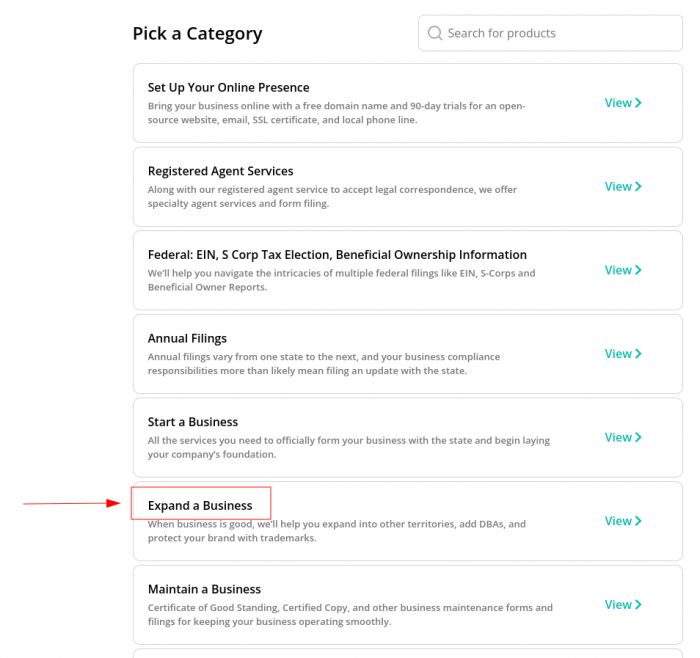

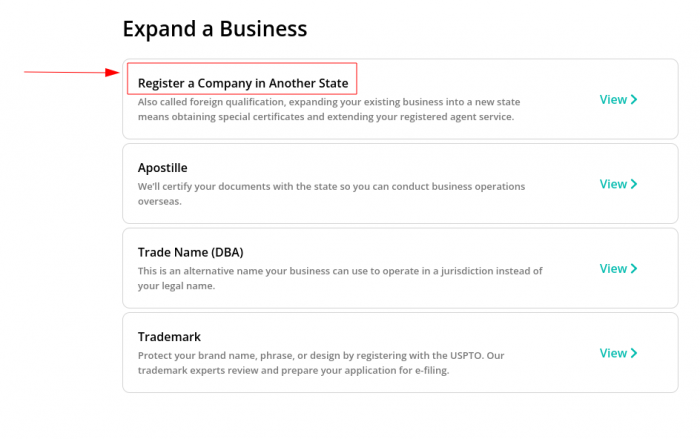

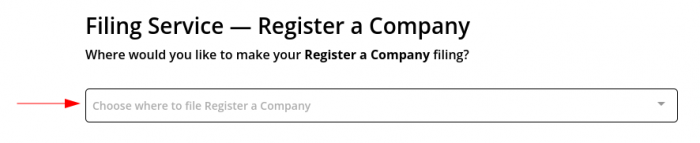

How to Register Out-of-State

The process of registering an existing business in another state is called foreign registration, or foreign qualification. The best part about forming your Delaware LLC or Delaware Corporation with us is that you can easily foreign register your company in another state, wherever and whenever you want. How?

Frequently Asked Questions:

How much does it cost to register a Delaware company out-of-state?

It depends on the state where you’d like to register. When you hire us, here’s what you’ll pay:

Certificate of Good Standing in Delaware

$50

Out-of-State Registration Fee

(varies)

Our Service Fee

$100

TOTAL:

$150+

Foreign registration fees vary state-to-state. For example, New Jersey and Maryland charges $130 and $155, respectively, while Pennsylvania charges $250. In general, you can expect to pay anywhere between $100 and $300.

How do I know if I need to register my company in another state?

This is determined by whether your company’s activities fall under the state’s legal definition of “doing business” (sometimes referred to as “conducting business”). Most state statutes don’t define these terms outright. For example, 6 DE Code § 18-912 lists activities that are NOT considered doing business. (Most states have a similar statute.)

But, in general, activities that help generate income for your business are considered “doing business.”

Get Foreign Qualification Outside DE Today

If you plan to do business outside of Delaware, we’ve got you covered.

We’ll take care of all the paperwork so you can legally do business in another state.

A Registered Agent, Inc. Ratings

Our customers have provided 62 reviews, giving us an overall rating of 4.3 stars out of 5 on Google